The Buzz on Offshore Banking

Table of ContentsSee This Report on Offshore BankingSee This Report about Offshore Banking4 Simple Techniques For Offshore BankingThe Best Guide To Offshore Banking

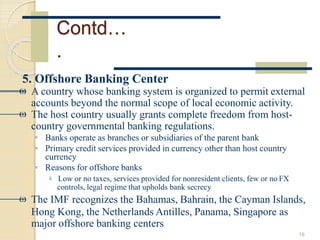

These accounts are generally opened up for a holding firm as opposed to a person. Trading this way offers financiers with desirable tax therapy, which puts even more cash back right into their pockets. The Bottom Line Going offshore is usually an alternative indicated only for corporations or people with a high internet well worth.When overseas financial units take down payments from global financial institution or various other OBUs, then they provide in Euro markets. Here is a vital point to take into consideration that such systems can not take deposits or offer cash

to the individuals of the country nation they are presently locatedSituated OBUs have actually gotten around the world popularity, particularly in Europe, the Middle East, the Caribbean, as well as Asia because the 1970s.

Below, even if an offshore financial device takes on the moms and dad company's name, its monitoring system and also accounts are taken into consideration to be independent. Some situations assist in obtaining rate of interest rates from overseas bank systems. Noticeable offshore centres have reputations for assisting in all manner

of these unsavoury practices, though ample sufficient chances such activities may might exist for local regional financial institutions branches in Gibraltar, Guernsey, Jersey and as well as Isle of ManGuy

Banking solutions in the Western world are in disappointing shape. Below is what Global Financing says, as of this composing in 2021, of the 30 best banks in the globe: None of the 30 most safe banks in the world none are located in the United States.

Some Ideas on Offshore Banking You Should Know

Offshore Banking: A Comprehensive Overview. Of the 4 nations with the best national financial debt problem, the United States has two times the financial obligation of number two UK and also concerning 3 and also a half times more than numbers 3 and also 4 France as well as Germany.

The US had its debt score reduced by Requirement & Poor's, the most recognized company and also government credit report ranking firm in the globe. United States people do not have have legislations in their home nation banning overseas banking.

Bank of America Corporation, for instance, was just recently notified that it really did not pass the cardiovascular test. The examination wrapped up that the bank was $33. 9 billion bucks brief of the quantity of books they required to maintain 2 even more years of economic troubles. Also the agency that is meant to guarantee US financial institutions, the FDIC itself, is learn this here now much short.

The US Federal Book is skating on slim ice. The resources ratio it holds is a puny 1. 24%. Think about it. Lehman Brothers was at 3% when it declared bankruptcy. In a current evaluation, there was $50. 7 trillion of financial obligation that was owed by US households, companies, and also federal governments.

The Definitive Guide to Offshore Banking

We saw our moms and dads going to the financial institution, transferring their hard-earned money into banks, thinking financial institutions were safe. It's a bank.

Offshore Financial: A Comprehensive Guide. Of the 4 countries with the biggest national debt concern, the United States has twice the financial debt of number two UK as well as regarding three as well as a half times even more than numbers 3 and also four France and also Germany.

The United States had its debt score reduced by Standard & Poor's, the most recognized corporate and also government credit scores ranking firm in the globe. US people do not web have have laws in their house country banning offshore banking.

Offshore Banking for Beginners

The US Federal Book is skating on slim ice. Assume about it. 7 trillion of financial obligation that was owed by United States households, organizations, as well as governments.

We saw our parents going to the financial institution, transferring their hard-earned money right into financial institutions, believing banks were secure. It's a bank (offshore banking).